Table of Contents

- Kelly Pruneau Makes Techweek 100 in Kansas City

- Sherry Turner featured in Startland News

- KC Entrepreneurs Talk Funding, Business Advice at BIG Breakfast - TBB

- Kansas City area aims to fix weak link between investors and entrepreneurs - Kansas City Star

- Sherry Turner, Founder of OneKC for Women Alliance, to Receive Legacy Award

- MU School of Law Selects Polsinelli’s Cortney Mendenhall for Top Honor

- Where Women Entrepreneurs Can Find Support in Kansas City

- To Get Promoted, Women Need Champions, Not Mentors!

- Aratana Therapeutics files first earnings report as public company

- In The Spotlight: Exporting

- Changing the Face of Angel Investing

- Women Hold Key to Overcoming Innovation Gap, Talent Shortage, Says OneKC for Women

Kelly Pruneau Makes Techweek 100 in Kansas City

Congrats to Kelly Sievers Pruneau, Women's Capital Connection, for making the Techweek 100 in Kansas City. Read the full press release below for more information.

Congrats to Kelly Sievers Pruneau, Women's Capital Connection, for making the Techweek 100 in Kansas City. Read the full press release below for more information.

WCC Network Manager, Kelly Sievers Pruneau Makes Techweek 100 Cut

KANSAS CITY, MO (Sept. 8, 2015) — Techweek recently announced the 2015 Kansas City Techweek 100 and Women’s Capital Connection (WCC) Network Manager, Kelly Sievers Pruneau, makes the list.

The Techweek100 identifies leaders who have made a significant impact on the technology and innovation ecosystem in which they operate. The Techweek100 includes leaders of fast-growing tech companies, prominent investors, key enablers of the digital ecosystem, creators of new technologies, and other innovators that make important contributions to their field.

As part of OneKC for Women, the WCC plays an important role in the financial success of women. WCC is the angel investor group that invests in women-led companies in primarily the KC region.

“Our job is simplified due to the hard work of Network Manager, Kelly Pruneau,” said Sherry Turner, founder of OneKC for Women and the Women’s Capital Connection. “Kelly helps women entrepreneurs prepare for their investment pitch and makes sure the deal is truly fundable for the investor review. On behalf of every investor in WCC and all of us here at OneKC for Women, we are so proud of Kelly for making the Techweek 100."

The Techweek100 is not a ranking, but rather an annual list of 100 most distinguished technology organizations and their leaders selected by the Techweek community, Techweek Advisory Boards, and the Techweek team.

This year, the WCC will surpass all previous year’s backings, having already invested over $700,000 in area startup and early stage businesses — both women-led and non-women-led— through July. The bulk of the investments, nearly 70%, are women funding women-led businesses.

Sherry Turner featured in Startland News

Sherry Turner talks diversity, funding landscape

August 27, 2015

There are few people in Kansas City that have worked harder than Sherry Turner to increase women’s engagement in entrepreneurship.

Founder of OneKC for Women, Turner works to help women in the area find jobs, start businesses, get financing or invest in other businesses through a variety of organizations. After years leading large corporate teams, she now helps guide the Women’s Capital Connection, Women’s Business Center and Women’s Employment Network.

Founder of OneKC for Women, Turner works to help women in the area find jobs, start businesses, get financing or invest in other businesses through a variety of organizations. After years leading large corporate teams, she now helps guide the Women’s Capital Connection, Women’s Business Center and Women’s Employment Network.

Turner recently participated in Startup Grind Kansas City, discussing her work, Kansas City diversity and the area funding landscape. To learn more about Startup Grind and its upcoming speakers like Sprint CEO Marcelo Claure, click here.

Here are a few snippets from Turner’s conversation with area businesspeople.

On engaging more women in entrepreneurship …

I think we have to be really intentional about labeling. … The startup community’s always been very white male-led. I mean, that’s the facts across the country. I think that after tonight we have to be more intentional about being a part of this (community) as well and drive that even through our e-newsletter and try to do some cross-promoting on stuff. … Our goal would be to have the resources available to have women gain the confidence.

On her work to create a micro-lending platform in KC …

Small businesses really couldn’t find access to capital. What we’re able to see is that the KC market is large enough that we should have multiple microloan programs because you can leverage federal dollars available to establish a loan pool and keep that viable. So our goal is to get the second one going. … We’re going to do our first 20 loans over the next several months with women-led (businesses) because we know those companies and then we’ll open it up in January to the general public.

On advice for attaining capital …

If you’re doing it alone — as in you’re not seeking out advice from people that have already been there and done that to help you evaluate, if you’re trying that decision on your own — I don’t think you’re utilizing the people that are willing to help around you. … We don’t claim to know everything, but we always know somebody that (can help) because they trust who we are and will sit down with you and give insight.

On her managerial skills …

In my corporate career, I managed 1,100 people at a time, so that was a training ground. Honestly, this is crazy, but it’s easier to manage that than small staffs. It’s layered kind of. You know you have direct reports who are responsible for tasking, and you’re managing strategies. I learned early in my career what it means to be a 50,000-foot level thinker in terms of that strategy, because I had that operational demand. But then as I moved into other careers with small staffs, you become tactical and you have attention to detail and you’re in the weeds. Really, I think I learned (managerial skills) in the different jobs that I had when I had to be 50,000-feet and detailed.

Read the full article here.

KC Entrepreneurs Talk Funding, Business Advice at BIG Breakfast - TBB

It can be tough for young, growing companies to find funding in Kansas City, but it’s not impossible.

That was one of the takeaways from Thinking Bigger Business’ BIG Breakfast on June 11 at the Kauffman Foundation. The quarterly breakfast features stories and insights from four local entrepreneurs, many of whom have appeared in recent issues of Thinking Bigger Business.

That was one of the takeaways from Thinking Bigger Business’ BIG Breakfast on June 11 at the Kauffman Foundation. The quarterly breakfast features stories and insights from four local entrepreneurs, many of whom have appeared in recent issues of Thinking Bigger Business.

This time, the panelists included Jeff Blackwood of ABPathfinder, Callie England of Rawxies, Lisa Sackuvich of ARJ Infusion Services and Dr. Michelle Robin of Your Wellness Connection.

England’s company relocated to the West Coast for a time, but eventually moved back to Kansas City, where she’s benefited from working with programs like the Pipeline Entrepreneurial Fellowship and plugging into the business community.

She said that it can be more challenging to locate funding here, but pointed to two local groups—the Women’s Capital Connection and the Mid-America Angels—that have helped Rawxies grow.

Blackwood echoed England’s comments. He said that ABPathfinder was fortunate to find a great angel investor in the form of Matt Watson of Stackify. Networking has helped the company secure further VC investments from FCA Venture Partners of Nashville and Dundee Venture Capital in Omaha.

More out-of-town investors are starting to pay attention to Kansas City companies as they see other investors successfully exit from positions they’ve held in KC startups. It doesn’t hurt that Kansas City has a reputation for a powerful work ethic.

Each panelist’s company offers a product or service that helps with customers’ well-being.

Rawxies, for example, makes a line of vegan, gluten-free snacks, and Your Wellness Connection provides a range of wellness services. Dr. Robin also hosts a radio show, delivers talks on better health and writes books—in fact, she has a new book coming out next month. She’s set a goal of influencing 1 billion people to achieve big shifts in their health by making a few small changes in their behavior.

ABPathfinder has developed a software solution that makes autism therapists more efficient when assisting clients.

ARJ Infusion Services provides home-based infusion therapies that allow patients to continue living life on their terms. The company is on pace to hit a 20 percent increase in revenue this year.

“Our mission is making the patient experience excellent,” Sackuvich said.

Read additional articles on Thinking Bigger Business Media website here.

Kansas City area aims to fix weak link between investors and entrepreneurs - Kansas City Star

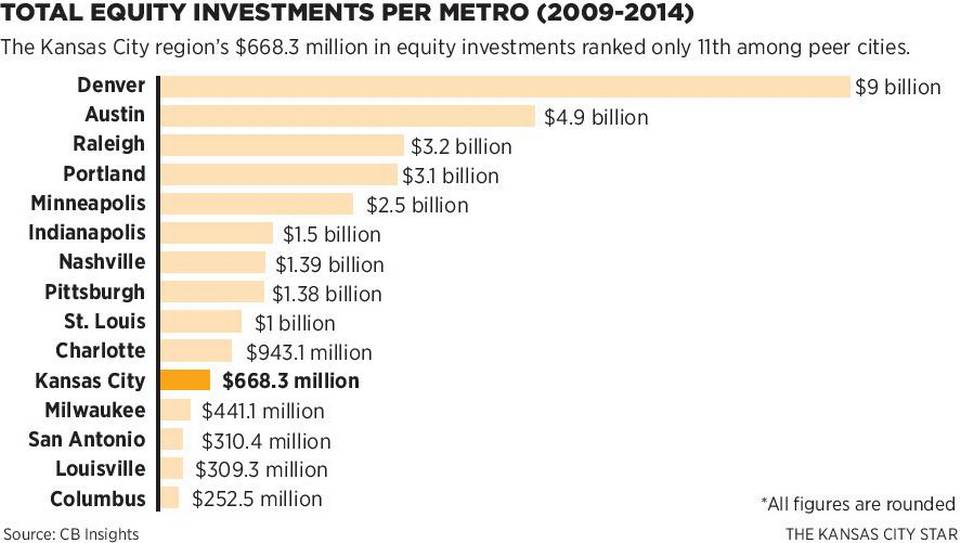

Four years ago, an ambitious program for the Kansas City area set “becoming America’s most entrepreneurial city” as one of its five top goals. But a big barrier has stood in the way: Not enough investment money has been getting to enough startup businesses.

Leaders of the Greater Kansas City Chamber of Commerce and the entrepreneurial community today will introduce a plan to leap that hurdle by building up local investment funds to help grow and keep business startups in the area. It’s either that or continuing to lose them to cities where investors are more likely to take interest.

Why should this matter to non-entrepreneurs? Data show that businesses less than five years old have been adding two-thirds of all new jobs, and job growth is essential for any region to prosper.

“We’ve seen a number of companies leave the area because of a lack of capital formation here,” said chamber chairman Terry Dunn. “We need to make the dollars and keep the dollars in our backyard instead of losing them to New York or other venture capital centers.”

Financing experts say people trying to start businesses in the Kansas City aren’t aware of all the resources and funding sources available. They say there’s a relative shortage of venture capital funds for a metro area of this size. And they say the area needs more skilled venture fund managers to help bring promising entrepreneurs and financiers together.

The new “We Create Capital” strategy to be announced today at Kauffman Foundation Conference Center includes three key aims:

- Create better community awareness about available startup funding sources.

- Build stronger ties between wealthy people or companies who could unite as venture capital investors.

- Cultivate a deeper talent pool of people to manage more venture capital funds.

“We are looking to de-risk some of the natural risk in business startups,” Dunn said. “And we’re looking for people with the ability to spot entrepreneurial talent and know the right opportunities for funding.”

Meanwhile, the chamber is lobbying in Topeka, Jefferson City and Washington to keep legislative attention on the need for government-backed startup loans and other funding.

“We need to put pressure on our state governments to say that these states are open for business,” Dunn said. The strategy is based on extensive research by the Ewing Marion Kauffman Foundation and KCSourceLink. The latter program, housed at the University of Missouri-Kansas City, is a network of about local 240 organizations, mostly nonprofits and educational institutions, that deal with early-stage business development.

Maria Meyers, who heads KCSourceLink, said research identified “networked capital” as a notable weak link in the Kansas City area. “Our entrepreneurial resources here are extremely strong, but there’s a lack of coordination,” Meyers said. “Fragmentation makes it difficult for entrepreneurs to identify and access appropriate funding sources.”

She added: “We’re leaving millions of dollars on the table. We need to fill the gaps. …This is what KCSourceLink does and can do more — pair the right person with the right money.”

The new strategy aims to at least double by 2020 the current amount of local venture capital investments that run in the $1 million to $10 million range. Now, the KCSourceLink report says, local investments of that type and size total about $43 million. Ideally, the figure can be pumped up to more than $180 million by 2020, advocates say.

Similarly, the goal for seed capital investments — an earlier funding stage than venture capital and generally for less than $1 million — is to increase the local investments total from just $2.9 million to more than $10 million.

The group also wants area entrepreneurs to take better advantage of existing federal and state grants for early-stage or research-and-development businesses. The goal is to raise their local use from the current $2.6 million to about $6 million. The metro area lags far behind St. Louis and even outstate Missouri and Kansas in obtaining such available funds.

For earliest-stage entrepreneurs, the strategy aims to build up microloan and other “alternative” loan programs, the kind of funding that goes to startups that don’t qualify for bank loans. Currently, the Kansas City area is accessing only about $3 million in alternative loans. The goal is to increase access to more than $10 million.

OneKC for Women, the umbrella organization for The Women’s Employment Network, Women’s Business Center and the Women’s Capital Connection, and KCMO CDE, a community development entity focused on Kansas City’s most economically distressed communities, have agreed to pursue underused loan programs, such as through the U.S. Small Business Administration and U.S. Treasury.

Those two organizations already are affiliated with the successful KC Regional Microloan Program that was created three years ago but has served fewer than 300 businesses.

For the bigger-ticket funding — venture or equity — Dunn said wealthy people increasingly are looking for entrepreneurial investment opportunities, but they need possibilities to be vetted by experts before committing money.

“They want to invest in businesses they understand, and we need to develop fund managers who can help young companies grow and connect them to interested investors,” Dunn said.

Planners cited several other local entrepreneurial-development assets, including the Kauffman Foundation. Dunn mentioned Flyover Capital, a venture investment group that’s majority owned by the Bicknell family, as well as efforts undertaken by UMB executive Peter deSilva to coalesce area venture capitalists.

Chamber president Jim Heeter said he takes heart that Kansas City is one of a handful of cities nationally that are spotlighting entrepreneurial development. He said planners have studied successes in Austin, Texas, and Nashville, Tenn., to help guide the next steps.

Heeter also emphasized a regional education goal: “We hope to create a community that sees entrepreneurial investment as a philanthropic thing for the good of the city.”

Read more on the Kansas City Star's website here.

Sherry Turner, Founder of OneKC for Women Alliance, to Receive Legacy Award

Sherry Turner, founder of OneKC for Women, has been selected as the 2015 Legacy Award recipient by Thinking Bigger Business Media. Each year, Thinking Bigger Business Media presents the Entrepreneurial Legacy Award to a leader in Kansas City's small business sector. The recipient is a leader who has made outstanding contributions to impact the entrepreneurial community.

This year, Sherry Turner, founder of OneKC for Women is deserving of this prestigious recognition for her dedication to helping women achieve their career goals. She is known for providing a voice for women seeking to reach their full personal and professional potential.

OneKC for Women is an alliance of organizations-the Women's Employment Network, the Women's Business Center and the Women's Capital Connection-that help women pursue their professional and financial goals. By working together as OneKC for Women, these partner organizations are able to better accomplish a common goal: empowering women to achieve financial independence.

As founder, Sherry’s vision was to establish OneKC for Women with the resources, opportunities and connections needed to advance employment opportunities, start a business, grow a business or receive guidance and support in overcoming barriers to success. Whatever resources a woman needs, the alliance is helping support each individual on her journey.

This initiative of collective organizations working together is advancing women in Kansas City by leveraging and elevating each other. Sherry believed this could be accomplished while reducing the overlap of women services. Many organizations aspire to develop collective impact, OneKC for Women has achieved it.

Turner has a long history of working on behalf of Kansas City small businesses through previous service with the Greater Kansas City Chamber of Commerce and the Kansas City Area Development Council.

Past winners of the Legacy Award include Bert Berkley, William H. Dunn Sr., Donald J. Hall, Patricia Brown-Dixon, Danny O'Neill, Barnett Helzberg, the late Ewing Marion Kauffman and many more.

Turner and the winners of this year's 25 Under 25® Awards will be feature during a gala event on Feb. 28 at the Downtown Marriott's Muehlebach Tower.

We hope that you will join us in congratulating Sherry Turner on this prestigious and well-deserved honor!

MU School of Law Selects Polsinelli’s Cortney Mendenhall for Top Honor

Mendenhall, a member of Women's Capital Connection, was chosen for Distinguished Recent Graduate Award and was honored April 25, 2014 at the MU School of Law.

The University of Missouri School of Law selected Polsinelli’s Cortney E. Mendenhall as its 2014 recipient of the Distinguished Recent Graduate Award. Mendenhall is a shareholder in the firm’s Life Sciences Practice who focuses on concept to market issues for startup and technology companies, among others. Her recent client results include representing a specialty pharmaceutical company in its $100 million sale to a publicly held company. In addition, she is very active in mentoring law students and entrepreneurs.

“Cortney is a great role model for our more recent graduates because of her dedication to the practice of law, her professionalism and collegiality, and her willingness to help train the next generation of law students,” said University of Missouri School of Law Dean Gary Myers.

Where Women Entrepreneurs Can Find Support in Kansas City

KCUR Central Standard host Gina Kaufmann chats with Women's Capital Connection network manager, Kelly Pruneau and Hilary Brown, founder and CEO of Hilary's Eat Well.

KCUR Central Standard host Gina Kaufmann chats with Women's Capital Connection network manager, Kelly Pruneau and Hilary Brown, founder and CEO of Hilary's Eat Well.

To Get Promoted, Women Need Champions, Not Mentors!

Vickie Elmer discusses how instead of adding a mentor or more Twitter followers this fall, women need someone far more powerful for their career if they want to succeed: a sponsor…

Click here to read the full story!

Aratana Therapeutics files first earnings report as public company

Click here to read the full story on the starting success of Aratana!

In The Spotlight: Exporting

Your business has survived the startup phase. You have employees, a product line and you’ve found your customers.

Congratulations, you have entered the “second stage” of business. Next stop: world domination.

Second-stage firms have 10 to 99 employees and/or $750,000 to $50 million in revenue—and while they may have survived the struggles of the startup, they still have their own growing pains, among them, how to enter the global market and find new customers beyond their own borders.

With 96 percent of the world’s population and two-thirds of its purchase power outside of the United States, you can’t ignore the vast growth opportunities international markets offer to your business. Not sure where to start? Check out the tips here and on the KCSourceLink blog.

Changing the Face of Angel Investing

This is a guest post to Forbes.com by Rania Anderson, an entrepreneur who accelerates women’s professional and business success through executive coaching, her blog The Way Women Work, speaking engagements, mentoring and equity investments. She is a cofounder of the women’s angel investor network, the Women’s Capital Connection.